In the ever-evolving world of financial transactions, chip and pin technology has emerged as a game-changer. It’s a secure and convenient way to make payments, reducing the risk of fraud and enhancing customer experience.

Chip and Pin Technology

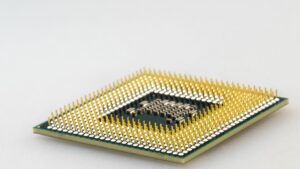

Chip and pin technology, often associated with payment cards, integrates a computer chip with a personal identification number (PIN), ensuring secure financial transactions. Unlike traditional magnetic stripe cards, the chip and pin variant houses a microchip decidedly more difficult to duplicate. Transactions require the cardholders’ PIN, a component not found on the card itself, increasing security levels for card usage.

On dipping a chip and pin card into a payment terminal, the chip communicates with the terminal to verify the card’s authenticity and the PIN is entered, a process known as two-factor authentication. It is this second layer of security, validated additionally by the issuing bank or financial institution, that makes this technology ideal for in-person transactions. Hence, chip and pin technology’s popularity has surged amid businesses and consumers, setting strong security standards in the payment landscape.

How Chip and Pin Technology Works

Chip and pin technology’s efficiency roots in its two-stage verification process. First, the microchip embedded in the card communicates with the payment terminal. It’s a digital conversation, exchanging details securely. In the second part, the terminal prompts for a PIN. The cardholder must input a unique four-digit code. Correct entry authorizes the transaction, falsely entered, it blocks the payment.

Remember, it’s possible to encode the card’s chip with the PIN, which cardholders set themselves. This encoding engages a secure encryption technology. Any attempt to retrieve data held on the chip with malicious intent, it’s met with advanced cryptographic countermeasures. Ensuring the encoded information remains a secret, it retains high security for your transactions.

During the transaction process, the card never leaves the cardholder’s sight. Thus, reducing opportunities for fraudsters to intercept, clone, or steal card information. Addressing security gaps found in traditional magnetic stripe cards, chip and pin technology revolutionizes card-based transactions, making them more secure, efficient, and reliable.

Global Usage of Chip and Pin Technology

Chip and Pin technology, recognized for its advantages in transaction security and convenience, enjoys widespread adoption globally. Expert reports say that, globally, over 80 countries, including Australia, Canada, and majority of European nations, favor chip and pin technology over traditional magnetic stripe cards. A study found that in 2019, 98.5% of in-person card transactions in Europe involved chip and pin cards. Regarding North America, data shows Card-Present fraud (CP) cases closed by 48% following the introduction of chip and pin technology.

The application of chip and pin technology isn’t confined to financial institutions. It’s expanded to industries like retail, transport, and hospitality, boosting transaction efficiency as they embrace it. Interoperability, a distinctive attribute of chip and pin cards, ensures cardholders make secure international transactions. Countries reluctant to adapt to this technology mainly pivot on transaction speed concerns. However, ongoing advancements aim to resolve these obstacles, fortifying chip and pin technology’s future growth and global reach.

Future Prospects of Chip and Pin Technology

Chip and pin technology’s global adoption speaks volumes about its potential. It’s become a staple in over 80 countries, defining the new norm for secure, convenient transactions. It’s not just about financial institutions anymore; sectors like retail, transport, and hospitality are also reaping its benefits. The impressive decline in Card-Present fraud cases in North America further underscores its effectiveness.

While some reservations exist regarding transaction speed, they’re not enough to halt its progress. With continuous advancements, these concerns are being addressed, ensuring that chip and pin technology continues to expand its reach. As it stands, the future of chip and pin technology looks promising, poised to revolutionize the way we conduct transactions globally. Its potential is undeniable, and it’s safe to say that it’s here to stay.